The latest metrics from the Port of Los Angeles show that supply chain constraints continue to hover near record levels, a trend expected to continue into 2022.

During the monthly update, Gene Seroka, the port’s executive director, said container dwell times remain at or near all-time highs, with “significant volume coming our way throughout this year and into 2022.”

As of mid-September, containers were staying at terminals for six days, the highest level since the volume surge began more than a year ago. Rail waiting time on the dock was 11.7 days, compared to a recent peak of 13.4 days, four times the average number of containers waiting to be loaded onto rail cars.

The port’s Pool of Pools structure, which is jointly managed by Direct ChassisLink Inc. (DCLI) and two other intermodal equipment providers have been waiting 8.5 days (8.8 days was the recent peak) on the street to open space in warehouses. “Disruptions continue at every node in the supply chain,” Seroka said.

Lack of labor is the real headwind

“The biggest thing we see is the amount of time customers hold on to the structure,” Mike O’Malley, DCLI’s senior vice president of government and public relations, told FreightWaves in an interview. “In Los Angeles, for example, it’s probably 70% higher than normal.”

This has resulted in a large portion of the company’s fleet being used by customers who are keeping equipment longer.

“Maybe they’re doing it because the warehouse is full and they have a full container sitting there on a frame waiting to be unloaded,” O’Malley said. “Maybe they couldn’t find enough drivers to pick up the container sitting on a structure near the terminal or at a facility. It’s all those things across the supply chain, and a lot of it is labor-related.”

Hiring headwinds extend throughout the supply chain. Carriers continue to pay more to attract drivers, as shippers and warehouse operators struggle to find the dockworkers needed to unload goods and keep equipment flowing through the system.

A number of stimulus payments as well as enhanced unemployment benefits throughout the pandemic have restricted hiring. Several years of progress in e-commerce demand have also increased the need for increased headcount.

Under normal circumstances, DCLI said it has enough structure to cover the current flow of containers.

“If you have enough labor, while supply will be limited, you will see throughput in the warehouses that will keep that finished item flowing enough to where our chassis will be back in five and a half days, not eight days,” Ryan said. Hovik, Commercial Director at DCLI.

“In this case you will have enough structure to meet the demand,” Hovik continued. Without the labor issues, “you’re still running the system at a very high level of utilization,” he added. “But freight will flow reasonably well.”

I haven’t played the rate game yet

DCLI said it is seeing cases where truckers keep the chassis for an extra day or two in exchange for returning the equipment briefly before renting it again. At a rate of $20 to $30 per day, carriers would rather pay for the extra day than risk not having the equipment when you need it.

“Under normal circumstances, chassis rental prices and economics drive a lot of behavior,” Hovik said. “Right now, we’re not sure that’s true.”

When asked why DCLI isn’t raising rates in light of the current market or as an incentive for carriers to turn equipment around faster, Hovek responded: “Even if we doubled our chassis rates, it’s not clear that would work. It’s really a function of things outside of the trucker’s control that are Which defines this extended usage cycle that we see on our assets.

While the company is evaluating options to encourage faster delivery times, it is taking a long-term approach with its customers, sacrificing some gains today for established relationships and greater market share in the future. However, it acknowledged that increased chassis production costs will have to be addressed through pricing at some point.

Buy everything in sight

DCLI is the largest provider of intermodal equipment in the United States, operating a fleet of 140,000 marine structures out of approximately 600,000 in the industry. A subsidiary of Maersk (OTC US: AMKBY), the company has invested $2 billion over the past decade to grow its fleet from 64,000 units to the current level while simultaneously upgrading units to include items such as radial tires and GPS monitoring ) And lighting with LED.

The company buys all the chassis it can. It has secured capacity for more than 30,000 offshore and domestic structures in 2021 and 2022, but acknowledged that production headwinds at manufacturers are currently limiting additions to complexes.

The US Department of Commerce ruled last May that anti-dumping duties imposed at the end of 2020 on structures manufactured in China would remain in effect. China Intermodal Marine Containers (CIMC), the world’s largest hull manufacturer, was found to have dumped hulls on the market to manipulate prices.

The associated duties and tariffs remaining under Trump have pushed the prices of Chinese-made equipment three times higher than they were before the ruling. Moreover, US manufacturers did not ramp up production until after the ruling and are still operating at production sites.

24-hour port operations are a help, not a cure

Some ports in Asia and Europe operate 24 hours a day. But the ports of Los Angeles and Long Beach have historically operated two shifts that account for two-thirds of the day, with availability on Saturdays.

The Port of Long Beach recently announced a pilot program to expand gate hours for truck transportation. The port offers 24-hour service four days a week with a plan to remain open at all times. The Port of Los Angeles is testing weekend gate hours and will continue to promote off-peak time as a way for carriers to access the port.

However, truck drivers usually do not want to work unless the warehouses are open. Some are willing to pick up a container/frame and leave it at the drop-off yard, returning later to finish the shipment when the facility reopens. But this can eat into service hours requirements.

O’Malley, as well as port managers, said the change in gate hours at ports will require cooperation from warehouse operators as well as carriers.

“If you’re going to do it, you’ve got to do it across the board,” O’Malley said. “If warehouses aren’t running long hours or if truck drivers don’t have the opportunity to get enough cycles into their day, the benefit may be somewhat limited.

“It’s certainly going to be increasingly useful. And in order to optimize the system, you really have to open all the gates…allow them all to operate at that higher level of capacity.”

Pool of Pools equipment is used in approximately half of the chassis moves at the Los Angeles-Long Beach complex, with the remainder handled by private pools or a truck driver-controlled chassis.

West Coast continues to rise

The current dynamic – lack of ocean vessel capacity, never-ending queue of docked ships, slow rail service, scant vacant industrial warehouses, containers stuck at shippers’ facilities longer, etc. – is set to continue.

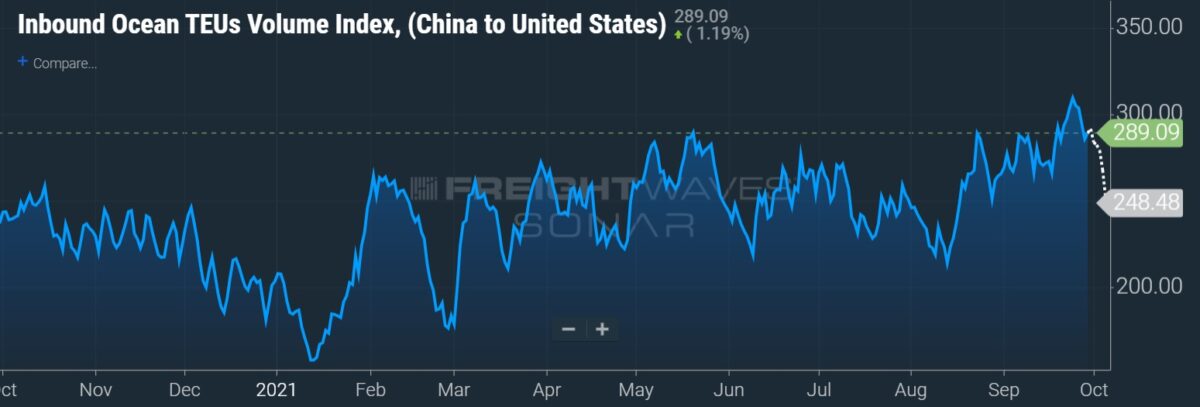

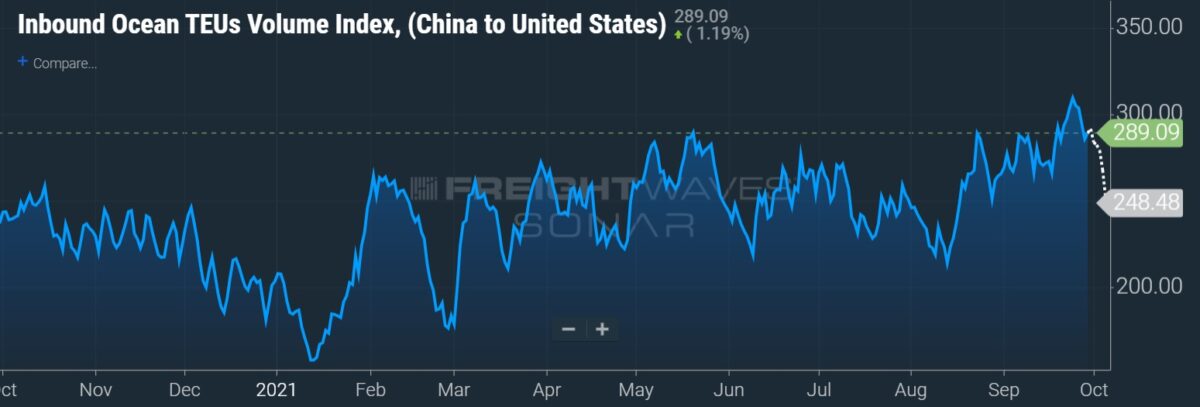

“Strong U.S. consumer demand has continued unabated for more than a year, evidenced by the steady amount of cargo flowing through the Port of Los Angeles,” the port’s August report concluded.

During August, the port handled 7.3 million 20-foot equivalent units, an increase of 30% year-over-year. The port expects to handle 10.8 million TEU in 2021, an increase of 14% over the record throughput of 2018.

Click for more FreightWaves articles by Todd Maiden.