Hannover, Germany – Daimler Truck is changing the battery chemistry of its future long-range electric trucks to boost driving range beyond 300 miles on a single charge while eliminating the use of cobalt and nickel.

The world’s largest truck maker showed off its eActros long-range electric truck for the first time on Sunday evening ahead of the opening of the 2022 IAA Transportation Expo.

Instead of the commonly used lithium-ion chemistry, the eActros long-haul truck will use lithium iron phosphate (LFP), and is expected to allow for more charging cycles and more usable energy per cell.

The truck will also be equipped with megawatt charging, which is not available in any current electric truck.

“Customers can go from 20% to 80% charge in less than 30 minutes,” said Karin Radstrom, Head of Mercedes-Benz Trucks. This should allow most charging needs to be met at fleet depots rather than through public infrastructure.

However, Daimler Truck is teaming up with rivals Volvo Group and Traton Group to create a $593 million European public truck charging infrastructure network. Daimler Truck North America is seeking to create a similar network in collaboration with BlackRock, Renewable Power and NextEra Energy Resources.

The new truck enters commercial production in late 2024 in Europe. The battery technology will support future versions of the market-leading Freightliner Cascadia. No timing has been announced. Freightliner has just begun commercial production of the eCascadia in Portland, Oregon. The eCascadia’s typical single charge range is 230 miles.

The eActros 300 is the basis for the current generation eCascadia. It has been in production for about a year in Europe.

Share products and technology globally

Daimler Truck AG, which becomes a stand-alone company in 2021, strives to achieve “maximum commonality” between its divisions, said Martin Daum, CEO of Daimler Truck AG.

Although sold in Europe under the Mercedes-Benz brand, the Daimler Trucks group is no longer part of the passenger car and light truck business which was renamed Mercedes-Benz in the spin-off.

“Everything you see here, you will see in the United States,” Daum said.

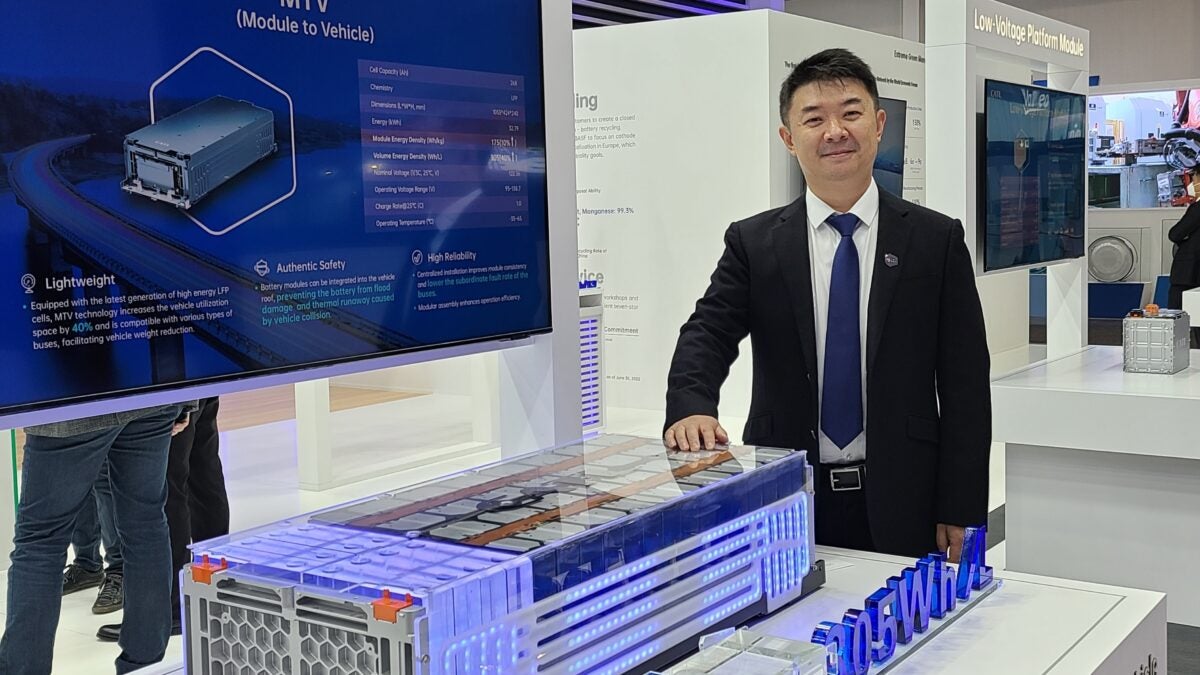

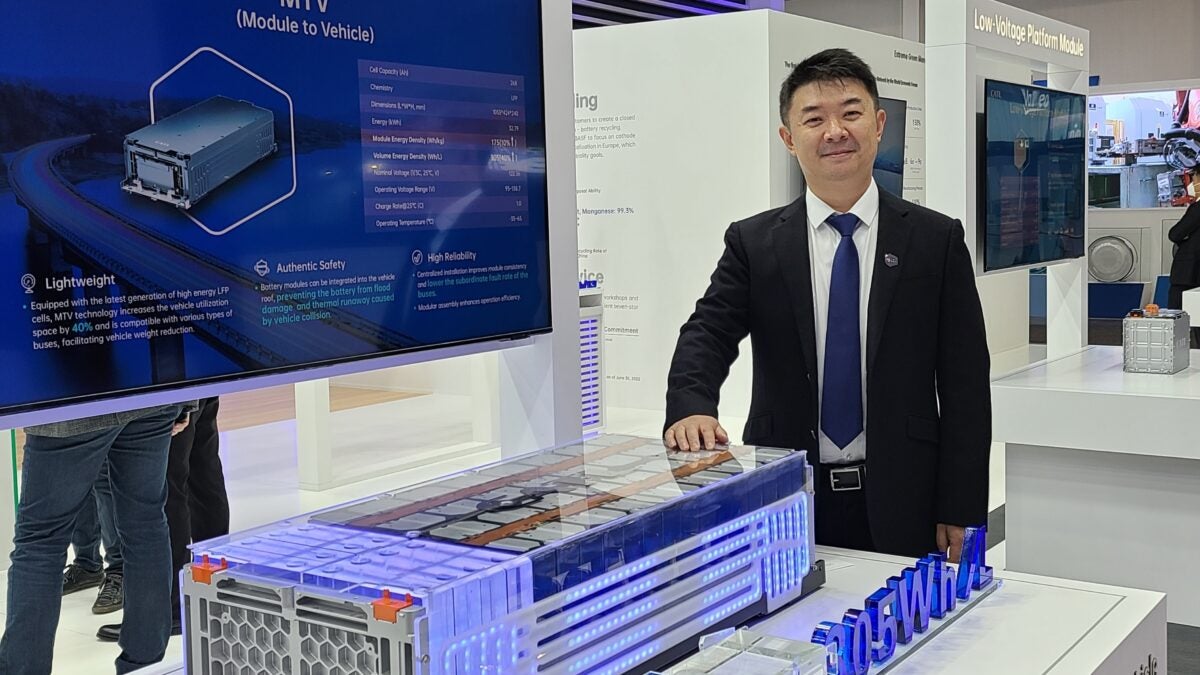

Contemporary Amperex Technology Co., Ltd. It is the main battery supplier for Daimler Truck (CATL). It is one of the world’s leading energy storage companies. The LPF chemistry is very new and the specific technology will be exclusive to Daimler, Daum said.

LFP chemistry has drawbacks — it’s not energy dense — but it’s durable enough to last for 10,000 cycles and safely use 100% of the battery pack’s capacity, Neil Young, CATL’s light commercial vehicle and truck sales manager, told FreightWaves. The market for truck electrification is still small, but CATL’s share is more than 50%, he said.

Natural gas is off the table at Daimler

Daimler continues to make improvements to diesel trucks but is focusing on electric and hydrogen fuel cells. In remarks to a media gathering on Sunday, Daum dismissed natural gas as part of the future of trucking. He made similar statements about Level 3 semi-autonomous trucks and platooning technology three and a half years ago. Industry has largely followed his leadership in both areas.

“We are convinced that our industry will need a dual strategy for sustainable transportation in the future,” he said. He added: “We are also convinced that we do not need a three-way strategy that includes natural gas. Gas engines are just an expensive bridge technology that still relies on fossil fuels that emit carbon dioxide.

Daum said drivers consider natural gas trucks weak because they are underpowered compared to diesel.

Up to 60% of all Daimler trucks sold in Europe by 2030 will be zero-emissions, Radstrom said.

The challenge of developing a dual infrastructure of green electricity and green hydrogen is crucial because “using off-grid electricity will not be enough.” Daum said. “We need to import and store green energy, and the best way to do that is green hydrogen.

“Building two infrastructures, one for green electricity and one for green hydrogen, will be less expensive than building just one infrastructure,” he said. “It may seem counter-intuitive. It is actually cheaper to scale two infrastructures to a moderate level than to scale just one infrastructure to an extreme level.

Related articles:

Major truck manufacturers are planning a European charging network

The million-mile-tested eCascadia has entered production

The newly independent Daimler Truck company achieved a 20% increase in group sales in 2021

Click for more FreightWaves articles by Alan Adler.