Although most countries in the world follow traditional European emissions standards, and pay a great deal of attention to European carbon dioxide standards for passenger vehicles, Europe has been surprisingly slow in dealing with carbon dioxide standards for heavy vehicles. As a result, the United States, Canada, Japan, and more recently China have established some form of heavy-vehicle efficiency standards without the benefit of traditional European leadership.

The European Commission appears to be satisfied with CO2 reporting requirements, which contrasts sharply with the importance the United States places on truck standards at the presidential level.

Europe’s plans for CO2 reporting requirements are based on two assumptions: the first is that such a reporting system will provide the end user with more information on which to base a purchasing decision, which will lead to increased competition between truck manufacturers, and thus effectively contribute to the adoption of The most energy efficient technology in trucks. The second reason, which supports the first, and which is clearly noted in the supporting memorandum, is that European trucks are actually becoming more fuel efficient than American trucks due to market forces caused by higher European fuel prices.

Let us explore the validity of these assumptions underlying the Authority’s newly announced strategy.

Are EU trucks more fuel efficient than North American trucks?

It is often said by European (and other) truck manufacturers that EU trucks are more efficient than those in the US and Canada, but there is little data to support this statement. Conducting a comprehensive fuel efficiency comparison involves a number of challenges. There are many factors – such as metrics (l/km, l/t*km), payload, vehicle speed, traffic conditions, emission control level, and terrain – which vary significantly from one region to another. For example, the European-wide truck speed limit is about 80 km/h, which is much lower than the average North American highway speed. As vehicle speed increases, fuel economy gets worse. So, while lower speeds in the EU should result in better overall fuel economy, it certainly doesn’t mean trucks are more efficient. As another example, in the passenger car market, it is easy to use liters of fuel per kilometer (L/km) as a measure of fuel consumption. However, in the world of heavy goods transport, the l/km scale does not reflect the efficiency with which a truck transports its load. Therefore, many see L/ton*km as a more representative measure. Again, this distinction complicates any regional (or even truck-to-truck) comparisons.

Polluting emissions regulations can also affect fuel consumption. As regulations on HDV emissions of particulate matter and NOx have tightened in recent years, OEMs have been forced to install aftertreatment and emission control systems on their engines. The United States and Canada mandated the use of diesel particulate filters (DPFs) on heavy trucks starting in 2008, while in the European Union diesel particulate filters (DPFs) were only required on trucks starting in 2014. These filters virtually eliminate harmful diesel emissions; But it has been proven effective to modestly increase fuel consumption.

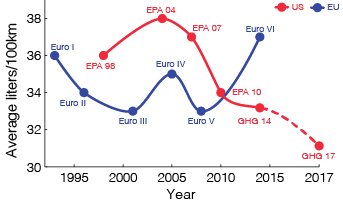

Average fuel economy values for towed trucks on US and EU highways (US in red, EU in blue). (Sources: EU average numbers from tests reported in Lastauto Omnibus and Trucker magazine as well as numbers in presentations from industry. US numbers reported by ACT Research to NAS panel. Future dates estimated from US Greenhouse Gas Regulation.)

Is there a way to compare the fuel consumption of North American and EU trucks? The first thing to look at is what is reported in the general literature. ICCT searched the available literature for in-use fuel consumption data on tractor trailers, and 25-year average fuel consumption values are summarized in the figure to the left.

The figure shows that although EU trucks have achieved slightly better fuel economy over the past two decades, North America has caught up with the EU in recent years and has begun to overtake the EU as of this year. The figure shows that NOx and particulate matter emissions regulations have affected fuel consumption (sometimes negatively) over the past 10 to 15 years. However, it is likely that as we move into the future, the regulations that will have the most impact on fuel consumption rates will be of the efficiency variety, as evidenced by the downward trend in North America. Published, reliable data can be scarce, and most of the data in the figure below comes from data reported in journals (for EU data points) and from fleets themselves (for North American data points). As mentioned previously, the large number of test-to-test variables can make direct comparisons unclear, so a wide range of fuel consumption values must always be assumed. The two main factors are (1) the EU’s transition to Euro VI standards (whose negative impact is likely to be temporary) and, more importantly, (2) the implementation of the first phase of the US HDV GHG standard (which has also been adopted by Canada).

Are EU trucks more efficient than North American trucks? This may have been true in the past, but the limited amount of data we have collected so far suggests that this is no longer true.

Since this type of broad regional comparison is limited, it’s also worth taking a look at truck technology. For example, efficiency technologies, such as aerodynamic technologies for tractors, trailers and automated manual transmissions, have different market penetrations in the European Union and North America. The best-selling models in North America in recent years have switched to aerodynamically streamlined trucks, and a large number of trailers are now equipped with aerodynamic devices (such as side skirts and gap reducers) as well. This trend is not entirely clear in the EU, and is most likely due to the fact that lower average speeds on motorways reduce (but certainly do not eliminate) the benefits to be gained. In addition, other legal restrictions (such as maximum overall truck length) in the European Union have had the unintended consequence of limiting the use of some aerodynamic devices. These restrictions are currently being removed, paving the way for further uptake of some aerodynamic technologies in trucks and trailers. Conversely, automated manual transmissions, which improve fuel economy over conventional manual transmissions by improving shift points and gear selection, have historically been more popular in the European Union, but have only recently gained more ground in America North. On the whole, it is fair to say that although the penetration of different technologies into the EU and North American truck market varies, there is currently no single clear technology winner.

However, Phase 1 greenhouse gas regulations in the U.S. and Canada, which went into four-year implementation this year, are accelerating the adoption of a number of technologies in the North American fleet, such as improved aerodynamic design and lower fuel use. Anti-roll tires, reduced vehicle weight, automatic idle stop, and speed limiters. Engine technologies such as friction reduction, improved aftertreatment, and turbo compounding are also coming to the market at increasing rates. Overall, the first phase of the regulation promises to improve the fuel efficiency of towed trucks from 9% to 23% between 2010 and 2018. The next stage of regulation promises to push the envelope even further, with technologies such as transmission optimization, engine/transmission integration, engine downsizing and downsizing, trailer aerodynamics, and even waste heat recovery. Will the same market forces lead to significant penetration of these technologies into the heavy vehicle market?

Are regulations needed to enforce technology adoption?

It is widely understood that strong standards can push cost-effective technology to market faster and with higher penetration than standard market forces. The fuel economy standards for passenger vehicles that have been adopted around the world are a prime example of this phenomenon. However, knowing this, the Commission still proposes to rely on market forces to push technologies into the HDV market. The Commission acknowledges that there are “market barriers to the uptake of energy-efficient technology” that slow or prevent the widespread adoption of cost-efficient technologies, and highlights the lack of reliable information as the main barrier it hopes to overcome through this. Carbon dioxide reporting plan. In fact, studies conducted in North America and the European Union show that lack of information is one of the biggest barriers to technology adoption. However, these same studies also show that most fleets are very reluctant to believe the numbers reported by government programs, instead preferring to test the technology themselves. In addition, a number of other barriers to adoption have been reported, such as lack of capital, unavailability, and split incentives. The Commission’s plan does not specifically address these additional barriers.

In fact, the current situation of heavy trucks shows some similarities to the situation of passenger cars in the EU a few years ago. For cars, in 1995 the European Commission adopted a strategy to reduce CO2 emissions based on three pillars: voluntary commitments from the automobile industry to reduce emissions, improving consumer information (CO2 labeling on vehicles), and promoting fuel-efficient cars through financial measures. . Twelve years later, in 2007, the Commission stated that the voluntary approach by car manufacturers was insufficient to achieve the goal of reducing CO2 emissions, and finally moved to a mandatory CO2 standard – which had proven to be significantly more effective in reducing CO2 emissions. Carbon Dioxide. . By failing to fully address all current market barriers or, alternatively, bringing the technology to market through the use of standards, the CO reporting scheme is unlikely to have any significant impact on HDV fuel consumption. It is very likely that since there is no EU standard for HDV efficiency within the next 10 years, North America will overtake the EU to become the leader in advanced truck technology. Since the EU’s annual sales volume of high-end vehicles is second only to China and the United States, and because many truck manufacturers are world leaders with significant exports to foreign markets, it is crucial that the EU adopts a more progressive stance on second-hand emissions. Carbon dioxide caused by HDVs.