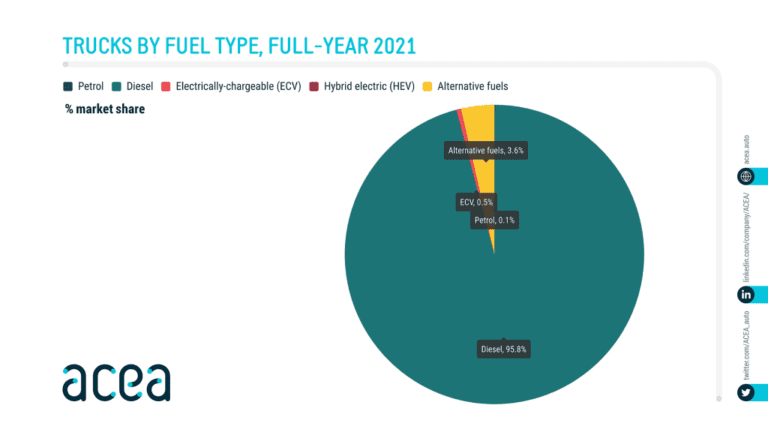

Brussels, 8 March 2022 – In 2021, diesel continued to dominate sales of new medium and heavy commercial vehicles in the EU, accounting for 95.8% of the market (96.5% in 2020). Plug-in vehicles accounted for 0.5% of new truck sales across the region (up from 0.4%), while alternative fuel vehicles accounted for a market share of 3.6% (compared to 3.0% in 2020).

Diesel and gasoline trucks

Last year, new diesel truck registrations in the EU increased by 13.6% to 255,099 units. With the exception of Cyprus, all EU markets registered growth, including the main markets in Western Europe: Italy (+21.9%), Spain (+7.1%), France (+4.9%) and Germany (+4.8%). In Central Europe, almost all countries saw gains of more than 10%. Poland was the third largest market for diesel trucks in the EU, with sales rising by 56.4% to 30,827 units.

By contrast, just 190 petrol trucks were sold across the EU last year, a decline of 9.5% compared to 2020, resulting in an overall market share of 0.1%. With 141 units sold (+7.6%), Finland accounted for the vast majority of total gasoline sales.

Alternative energy vehicles (APV)

Overall, in 2021, new electric chargeable vehicle (ECV)2 registrations grew by 26.6%, going from 982 units in 2020 to 1,243 electric vans in 2021. Looking at key EU markets, Spain recorded the strongest growth ( +137.5%). Followed by France (+88.5%), while sales remained stable in Italy. Germany saw modest growth (+15.8%), but with 987 units sold, it represented the vast majority of all new electric trucks in the EU. The Netherlands came in second place with 75 registered units (+82.9%). As a result, the share of major economy vehicles in new truck sales rose from 0.4% in 2020 to 0.5% last year.

Registrations of new hybrid electric vehicles (HEV) in the EU have seen a significant decline, with sales down 55.9% to 67 units. The market share of hybrid trucks shrank from 0.1% in 2020 to 0.03% of total truck sales in the European Union in 2021.

Alternative fuels, which include natural gas, LPG, biofuels and ethanol, accounted for the vast majority of alternatively-powered trucks sold across the EU in 2021, with an overall market share of 3.6% (up from 3.0% in 2020 ). Demand rose 40.7% across the region, bringing total units sold to 9,688 units last year. The main markets for alternative fuel trucks were Germany (2,258 units; +37.5%), France (1,858; +20.0%) and Poland (1,596; +119.2%).

Overall, in 2021, registrations of new plug-in electric trucks grew by 26.6%, going from 982 units in 2020 to 1,243 electric trucks in 2021.

Downloads

About the association

The Association of European Automobile Manufacturers (ACEA) is a Brussels-based trade association of 15 major producers of cars, trucks, lorries and buses in Europe. Members of the European Automobile Manufacturers Association are DAF Trucks, Daimler Truck, Ford Trucks, Iveco Group and MAN Truck. & Bus, Scania, Volkswagen Commercial Vehicles and Volvo Group Visit www.acea.auto for more information about ACEA, and follow us at www.twitter.com/ACEA_auto or www.linkedin.com/company/ACEA/ Contact: Francesca Piazza, Senior Director of Statistics, fp@acea.auto

About the automobile industry in the European Union

12.9 million Europeans work in the automotive sector 8.3% of all EU manufacturing jobs €392.2 billion in tax revenues for European governments €101.9 billion EU trade surplus More than 7% of EU GDP generated by the automobile industry €59.1 billion in Annual R&D spending, 31% of EU total

Fuels for new commercial vehicles