In 2022, the IRU, supported by field information from its members, continued to report and analyze the global motor shortage: a chronic problem that threatens the stability and continuity of mobility and supply chains. This article provides an overview of IRU’s efforts to analyze the situation, raise awareness and provide solutions.

For several years, the IRU has been publishing its global report on driver shortages.

In June 2022, after surveying more than 1,500 commercial road transport operators in 25 countries across the Americas, Asia and Europe, the IRU released its Global Driver Shortage Report 2022, which found that the sector is missing more than 2.6 million professional drivers.

In Europe, the driver shortage jumped 42% from 2020 to 2021, with driver vacancies reaching 71,000 in Romania, 80,000 each in Poland and Germany, and 100,000 in the UK. In Mexico, the shortage rose by 30%, reaching 54,000, while in China, it rose by 140%, reaching 1.8 million.

Commenting on the report’s findings, IRU Secretary General Umberto de Brito said, “The chronic shortage of commercial drivers is getting worse, with millions of jobs remaining unfilled. This puts already stressed economies and societies at greater risk of inflation, social mobility issues and breakdowns in supply chains.”

“Land transport operators are doing their part, but governments and authorities must remain focused, especially to improve parking infrastructure, access to training, and encourage more women and young people to pursue this profession,” Umberto de Brito added.

The report showed that women are still not in the driving seat. Less than 3% of truck drivers are women in all regions, with notable exceptions in China (5%) and the United States (8%). The rate for female bus and coach drivers in Europe is 12% better. However, these rates are all still well below transportation sector standards, especially in Europe (excluding the Netherlands) and the United States, respectively, where 22% and 28% of all transportation workers are women.

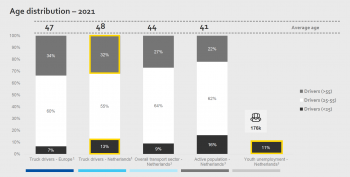

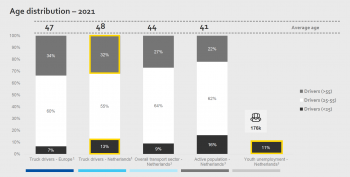

There is also a demographic time bomb. Young drivers under the age of 25 still make up a small minority, accounting for 6 or 7% of all truck drivers in most areas. On the other hand, there are between two and five times as many older drivers over the age of 55 in all regions, except China and Mexico. In the United States and Europe, older drivers make up about a third of the workforce. Europe has the highest average driver age at 47 years.

The widening age gap is even more critical for passenger transport. In Europe, only 3% of bus and coach drivers are under 25 years old, which is half the rate in the overall transport sector. Drivers over the age of 55 make up 32% of the workforce, with the average driver age being 50 years.

Driver shortage reports by country

Following the release of the global report, the IRU made 22 reports available exclusively to members on its intelligence platform in August, providing data-driven analysis on driver shortages in 19 countries.

Each report includes general indicators of the driver shortage and a breakdown of three demographic trends: age distribution, gender representation, and share of foreign drivers.

With support from IRU members, the briefings also provide contextual analysis of the findings and an overview of the challenges and solutions in each country.

A few weeks later, the IRU also released its detailed European report on the commercial driver shortage. The report, which is based on a comprehensive survey of 744 road transport operators in 15 European countries, includes economic indicators for the sector in the post-Covid phase, detailed figures on demographic and gender dynamics, and the main reasons behind the shortage.

Attracting young drivers: EU dinner discussion focuses on solutions

In October, the European Union Dinner Dialogue organized by the IRU in the European Parliament brought together the road transport sector and public authorities to explore solutions to the driver shortage. In particular, the focus was on how to remove barriers to entry for young people, improve working conditions, and mobilize automation as an opportunity to enhance the industry’s image.

Speaking at the event, Raluca Marian, EU Advocacy Director at the IRU, said: “The EU will have around 500,000 vacant driver positions by the end of the year. It’s a truly missed opportunity given the youth unemployment rate of 14.5%.”

“It is encouraging to see how seriously the sector is looking for solutions to the driver shortage, as well as the support from European parliamentarians and EU authorities. But the urgency of the situation is clear. We cannot continue on this path; it will lead us down a very dark path,” added Raluca Marian. “.

The dialogue was supported by the Czech Presidency of the Council of the European Union, and hosted by four MEPs: Petar Vitanov (TRAN), Dragos Pešlaru (EMPL), Maria Walsh (EMPL), and Andor Djeli (BUDG & TRAN). DG MOVE General Manager Henrik Hololy and Stanislav Dvořák, Director of the Czech Drivers Department, also gave keynote speeches.

In addition to more than 20 interventions by representatives and shippers from the sector, many young drivers, alongside experienced drivers, shared their experiences and how they believe the sector can attract new talent.

IRU President Radu Deniscu had a simple message in his closing remarks: “There is a good understanding of the challenges and possible solutions. Now is the time for us to act and put young drivers behind the wheel.”

Access and attractiveness of the profession

In addition to the global driver shortage report, the IRU released its first report on the attractiveness and accessibility of the profession in November.

The report – which assesses six countries representing two-thirds of Europe’s total road freight industry, and four countries representing 28% of the total passenger transport sector – showed that the shortage of truck, bus and coach drivers in Europe is spiraling out of control, driven by increasing demand for trucks and buses. Transportation demand and aging driver population.

Without action to make the driver’s profession more accessible and attractive, Europe could be short of more than two million drivers by 2026, affecting half of all freight movements and millions of passenger trips.

Although driver salaries are in some cases up to five times the average minimum wage, the report presents alarming data about the difficulties in accessing the driver’s profession, especially for young people, and its attractiveness, especially for women.

The minimum qualification age remains 21 for truck drivers in five EU countries, and between 21 and 24 for most bus and coach driver jobs across the EU (see below), which represents a significant barrier for school leavers.

High licensing and training costs are also a barrier. In France, a truck license costs €5,300, more than three times the average monthly minimum wage, while in Germany, a bus and coach license costs €9,000 on average, more than four times the monthly minimum wage.

Security, especially for women, is crucial to making the profession more attractive, with 95% of truck drivers and 94% of carriers placing it as their top priority. However, only 3% of existing truck parking spaces in the EU are certified safe and secure.

“Without drivers, the European economy, social mobility and climate plan will stall. But there are proven solutions, especially if industry and government work together,” Umberto de Brito said after the report was released.

The report also identifies 20 solutions currently being implemented by road transport associations, companies and shippers.

Full reports (passenger and cargo) are available to IRU members on the Intelligence platform.

Intelligence briefing: accessibility and attraction of drivers

Following the release of the report on the accessibility and attractiveness of the profession, the IRU held an intelligence briefing to discuss current and projected driver shortage rates and their impact on mobility and logistics, tools that facilitate access to the profession, and measures that increase the attractiveness of the profession.

The full symposium recording is available here. Here’s a short excerpt:

IRU’s Senior Director of Strategic Marketing Intelligence, Mary Ann Cervone, set the scene with her first presentation. “425,000: This is the number of vacant truck driver jobs in Europe. Since January of this year, we have observed a 44% increase in demand for truck drivers.

“Another number is 12,000. This is the number of bus and coach driver jobs that were unfilled in 2021 in four major European countries. Since January this year, we have also noticed a 43% increase in demand for bus and coach drivers. Mary-Anne Cervone added: “Based on current trends, the shortage of bus and coach drivers in these countries could reach 100,000 drivers by 2026.”

“We can see that there is still a significant difference in wages between Drivers working in Eastern and Western European countries.”

In conclusion, there is still an important difference between the East and the West despite the higher total driver salaries in the Eastern countries. “We still do not see real coordination at the European level,” Amelie Achard added.

“72% of drivers in Spain are 50 or older,” said Ramon Valdivia, CEO of ASTIC, who provided an overview of Spain’s driver shortage, including solutions and the political environment. “If the speed of onboarding of new drivers does not change radically In the next five years, we risk losing more than a third of our truck driving workforce.

“In my opinion, the sad truth is that no one wanted to heed the warnings issued by the industry. When we were heard, the measures taken were limited to theoretical studies of the phenomenon, without ever giving way to any coherent, permanent and economically sustainable plan,” he added.

“The driver shortage has increased dramatically in Romania, rising from 49,000 in 2019 to 71,000 in Year 2022.”

“Given the main challenges that have led to this situation, the minimum driving age is still a barrier that prevents young people from entering this profession. The number of truck drivers is still 21 years old, while in the case of bus drivers it is 24 years old,” Roxana Ili added.

Charles Anderson, CEO of Freightsafe, gave the final presentation, addressing a major issue limiting the profession’s appeal: the lack of safe parking spaces.

“Truck drivers are forced, either by law or human constraints, to stop driving and take breaks after a certain period of time. This means that at least 50% of driver interaction in this industry is when they are stationary,” Charles Anderson said. We saw this as a great opportunity to better communicate with drivers and began researching the cause of the significant parking shortage.”

“Our studies have shown that there are thousands of existing warehouses, ports, repair shops, shopping centers and real estate associated with trucks that could ideally be repurposed into small parking areas,” he added.

Freightsafe offers a modular parking solution at existing properties – such as warehouses, repair centers, depots, ports and truck parks – where drivers can safely park, store, swap and ship their trucks.

IRU position on the revision of the EU Driving License Directive

Finally, in November, with the upcoming review of the EU Driving License Directive scheduled to begin in early 2023, the IRU put forward a full range of proposals to revise the Directive and reduce the shortage of drivers in the EU, including by reducing the gap between schools and universities. wheel.

With industry proposals approved during the review, the current share of young drivers under the age of 25 (6% for freight and 5% for passengers) is expected to rise to 10% by 2030, putting the road transport industry on a strong, renewed path. long-term. The industry also aims to increase the share of female drivers to 10%.