A report published by Morgan Stanley Research on Wednesday highlights demand expectations and how hungry carriers and brokers are for freight. The 37-page report is a mix of survey data and pricing models, with forecasts and sentiment for the next three months indicating a negative outlook.

According to the survey, demand for freight remains strong, with one shipper saying: “The orders just keep coming in. I used to consider all the asset carriers I would come in contact with; I even started to be more selective about which asset carriers I would enjoy at this point.” Brokers, I’m flat out telling them we won’t be adding any new brokerage partners in 2023. Everyone seems starved for freight.

Concerns about off-market pricing capacity remain at the forefront. One broker said: “I have spent a lot of time talking with carriers, shippers, clients and other brokers. What I see and experience is a period where the market is trying to correct itself or return to normal. However, costs are still higher or increasing on an annual basis. In addition Additionally, when I compare customers who are causing price pressures to decline on both contract and spot rates, I see a lot of capacity leaving or going out of business. My concern is that as customers cut rates and cut back on their carrier partners, it will create a backlash. An excessive overall effect on the market and ultimately creates a situation for customers where prices will rise in the second quarter for the rest of the year.

Sentiment remains bearish with shippers, but brokers and carriers remain neutral. The report said that compared to the last check, brokers continue to push interest rates lower but the situation is significant. LTL pricing remains disciplined, but the big topic to watch is how carriers balance lower prices alongside higher labor and equipment costs.

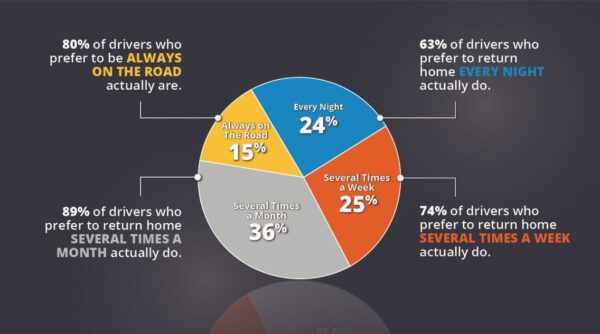

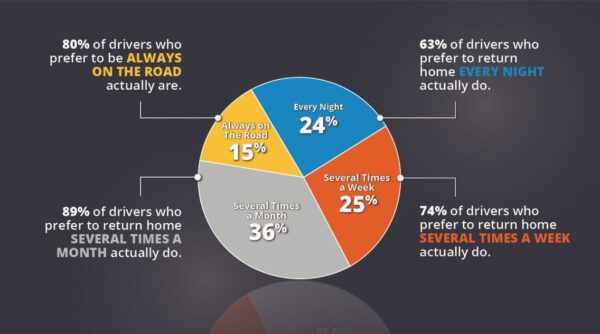

Truck driver route questionnaire on home time preferences

Trucker Path, a popular mapping and navigation tool for drivers, on Wednesday released data from a survey related to drivers’ preferences for getting home.

The good news from the results is that carriers for the most part seem to be doing a good job of getting drivers home. Regarding the data, Mark Solomon of FreightWaves wrote: “The survey…gave drivers four options to choose from: whether they wanted to go home every night, several times a week, several times a month, or never.” Results: 63% of drivers who preferred to go home every night were allowed to do so. About 89% of drivers who wanted to go home several times a month had their request approved.

Often times, in the trucking industry, the most important load is the one that gets the driver home, and survey data is a great tool to gauge the status of home time requests. For large truck carriers, failure to adequately accommodate driver leave requests can be costly; Often times it can take between $4,000 and $5,000 to accommodate a new driver from start to finish.

Market Update: FreightWaves Q1 Freight Sentiment Index results

FreightWaves on Monday released its first-quarter Freight Sentiment Index results, which were obtained from surveys provided to brokers, carriers and shippers in the first two weeks of each quarter.

In the results, while the earnings outlook for the first quarter looked bleak, there was data suggesting that the long-term outlook for profitability for this year had improved.

“Broker sentiment fell to 6.97 from 9.8, the most dramatic change among the three groups,” wrote Joe Antoshak of FreightWaves. “The same measure for shippers fell to 10.64 from 12.68. Meanwhile, carriers rose to 5.97 from 4.87. That’s a modest gain (and no It is still the lowest of the group), but it indicates more parity in the market.

Most equity research and anecdotal evidence from executives continue to suggest that conditions will deteriorate during the first half of 2023. Long-term profitability forecasts from our survey data appear to be consistent with the consensus for improving shipping market conditions in the latter half of the year. , where inventory ratios are adjusted due to changes in consumer demand.

FreightWaves SONAR Highlight: Diesel markets brace for a stormy February

Commentary provided by Daily Watch, a newsletter for SONAR subscribers.

Summary: On February 5, the European Union will start imposing a ban on Russian fuel imports, after which diesel markets should get uncomfortably interesting. On the one hand, French refinery workers went on strike to protest their government’s pension reforms, which reduced national supply. Unfortunately, the United States is far from ready to alleviate the supply crisis in Europe, given the current domestic shortage of distillate fuels. Last week, nearly 3 million barrels of diesel were diverted from Europe to New York, suggesting that diesel shortages in the Northeast are more serious than shortages across the pond.

How does this news affect diesel prices in the short term? Not much, at least for now. On Monday, national average diesel prices on trucks hit their lowest level since early March 2022, when Russia began its full-scale invasion of Ukraine, confusing energy markets. Since then, prices have risen just 1% to an average of $4.70 per gallon, although costs vary from region to region: California still pays an additional premium of $1 per gallon, while Texas markets are recording discounts due to their proximity to refineries. Refining and oil fields.

Orientation Guide: Links from around the web

Tax breaks for drivers, truck parking capacity part of new bipartisan bill (FreightWaves)

J.B. Hunt awards nearly $9 million in discretionary bonuses (Commercial Carrier Journal)

Tough year ahead as economic headwinds slow US truck operators (The Loadstar)

What can trucking expect from inflation numbers and interest rates? (trucking information)

Pay is the key factor for driver turnover but “it’s not always the amount an issue” (Commercial Carrier Magazine)

Al-Ahed misses expectations in a tumultuous fourth quarter (FreightWaves)